Cornerstone在人力资源技术领域长期以来一直是学习管理系统(LMS)的领导者。公司最近推出了Galaxy,这是一个集成了人工智能的全新人才管理平台。这一重大进展是在一系列收购之后实现的,尤其是最近收购了SkyHive,显著增强了公司的数据处理能力。Galaxy平台通过提供全面的技能发展、绩效管理和员工晋升系统,为HR技术空间树立了新标准。

Galaxy区别于市场上其他基于技能的或智能平台,例如Eightfold主要从人才获取开始,而Gloat着眼于人才流动性。Galaxy则从另一个角度出发,即员工发展,这是由Cornerstone在学习与发展(L&D)领域深厚的背景所支撑的。Galaxy系统内置了完整的用户界面,能够推断技能,让员工标记和评估自己的技能,帮助员工找到并完成各种学习形式,管理合规性和认证程序,通过任务、评估或管理辅导提升技能。

通过整合性能管理、发展计划、继任计划,以及招聘过程,Galaxy使公司能够通过绩效管理推动技能发展。在收购SkyHive之前,Cornerstone试图仅使用其LMS信息的数据集来实现这一目标,但这些数据并不足以构建完整的人工智能语料库。通过这次收购,Cornerstone获得了一个完整的劳动力市场数据系统、一个公司中立的职位架构以及大量行业技能,使Galaxy能够与其他主要的人才智能和人才市场供应商直接竞争。

Cornerstone spent the last decade acquiring LMS and talent software companies, all in a goal to build an integrated skills platform. Finally, after years of hard work and integration, the

company introduces Galaxy, an advanced offering in the world of AI-powered HR systems.

Before I explain Galaxy, the history is important. Founded in 1999, Cornerstone started as an e-learning platform company (CyberU). The company established a foothold in the emerging LMS market and grew through strong marketing, sales, and product innovation. Since then the company has gone public, reached a $5.2 billion valuation, and was then

acquired by a private equity firm (Aug. 2021, three years ago).

The new management team continued to acquire companies (EdCast, SumTotal, Talespin, and most recently SkyHive) and has now stitched these systems together into a unified platform called Galaxy. Galaxy, as I show below, is a skills-powered integrated talent management platform, built around the core of learning management. And this is what makes it unique.

The other talent intelligence or skills-based platforms started elsewhere. Eightfold started in talent acquisition; Gloat started in talent mobility; SeekOut started in recruiting; Beamery started in CRM; and players like Retrain.ai and NeoBrain started in more vertical domains. Each of these companies use large-scale profile data to infer skills, give companies tools to find and match candidates, and eventually to deliver learning.

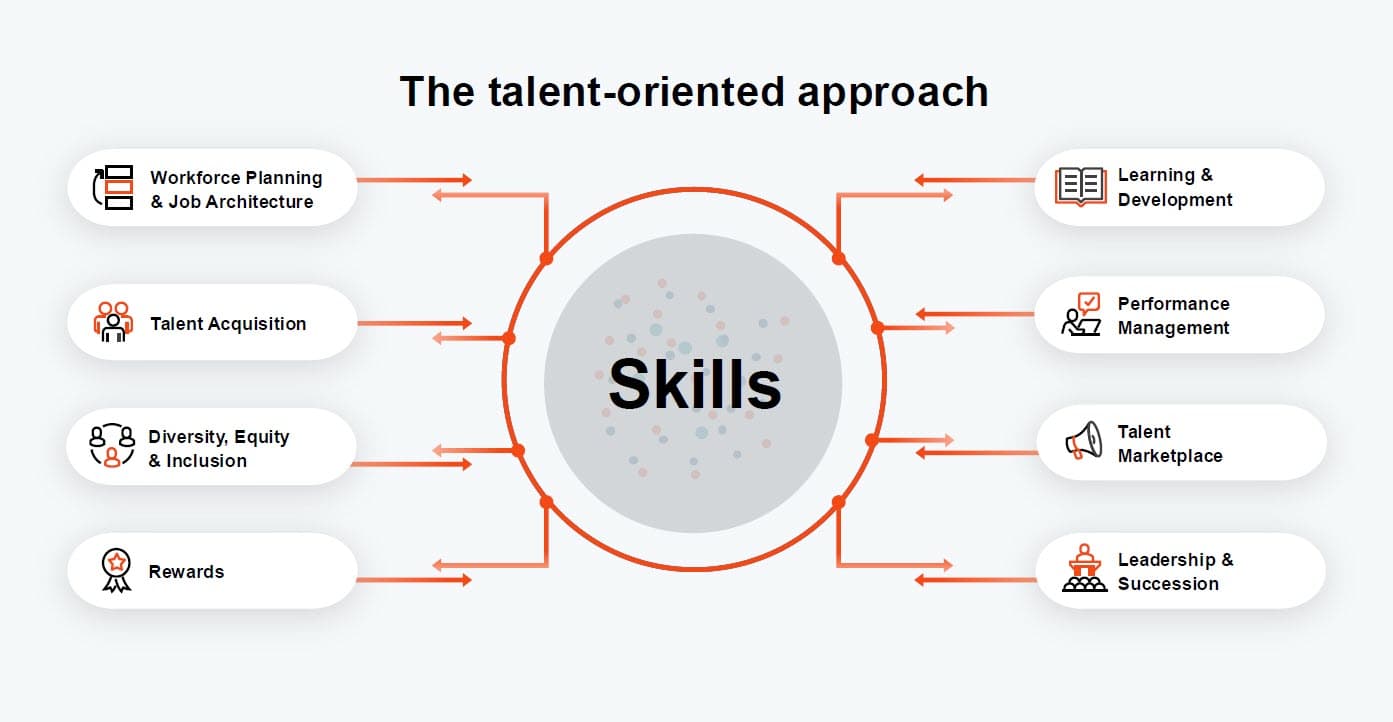

Cornerstone, with deep background in L&D, is coming at this from another direction: employee development. The Galaxy system, which is built into a complete user interface, infers skills, lets employees tag and assess their skills, helps employees find and complete many forms of learning, manage compliance and certification programs, and advance skills through gigs, assignments, assessments, or management coaching. And since Cornerstone is an integrated talent suite, the system lets companies drive skills through performance management, development planning, succession planning, and also recruiting.

Before the acquisition of SkyHive, Cornerstone was trying to do this with its own data set of LMS information. This data, which includes billions of learning records, was simply not sufficient to build out the entire AI corpus. By acquiring SkyHive, Cornerstone gained an entire labor market system of data, a company-neutral job architecture, and lots of industry skills. This brings Galaxy into direct competition with the other major talent intelligence and talent marketplace vendors.

I have not yet talked with Galaxy customers, but the user experience is integrated and shows the sophistication of thinking under the covers. Remember that Cornerstone acquired Evolv, Clustree, and EdCast before acquiring SkyHive, so the team has been building AI capabilities and use-cases for several years. And now that Cornerstone has a VR platform for learning, more use-cases are coming.

While I don’t know Cornerstone’s revenues, the leadership team assures me that the company is growing and the profitability is high. This means the company has long-term sustainability and despite its many acquisitions, is likely to evolve to “Oracle-like” status. (Oracle has acquired hundreds of companies over the years and now looks at M&A as one of its core strengths).

Here’s the major play in the market. With 7,000+ customers, Cornerstone has many customers shopping for new tools. If Galaxy is as solid as it looked in the demos, some percentage of these buyers could upgrade to Galaxy and avoid the purchase of Gloat, Eightfold, or another LMS. While we cannot be sure where Galaxy will play, for companies that want to deploy a skills architecture across all talent practices, it looks like a solid option.

Cornerstone Vision:

Cornerstone User Experience

Cornerstone Career and Talent Marketplace

Cornerstone Performance Management

Skills in Goal Management

Why Cornerstone Still Matters

Cornerstone User Experience

Cornerstone Career and Talent Marketplace

Cornerstone Performance Management

Skills in Goal Management

Why Cornerstone Still Matters

Cornerstone has a massive customer base. The users of Cornerstone, Saba, SumTotal, Lumesse, and Halogen include many of the world’s largest companies and thousands of mid-market organizations as well. These organizations have invested billions of dollars into learning infrastructure, content, and user portals to reach employees. If Cornerstone Galaxy delivers on its promise, the company can help many of these organizations avoid buying lots of standalone new tools. And given Cornerstone’s size, the company could become, as I mentioned above, the “Oracle” of the space.

And note, by the way, that a recent survey by HR.com found that the top rated HR tech issue to address is L&D infrastructure, so this issue is on everyone’s mind.

While the market is highly competitive and there are many skills-based tools in the market, Cornerstone’s focus on L&D is unique. None of the other major LMS vendors have the skills infrastructure of Cornerstone today.

If your skills strategy is focused on

building skills, Galaxy may be the answer.

More to come as we talk with more Galaxy customers.

Additional Information

扫一扫

添加客服

扫一扫

添加客服